- Home

- Retail Technology

- How a Leading Retail Brand Used Unacast’s Location Data Insights to Optimize Brick and Mortar Strategy

How a Leading Retail Brand Used Unacast’s Location Data Insights to Optimize Brick and Mortar Strategy

Benchmarking

Overview

Description

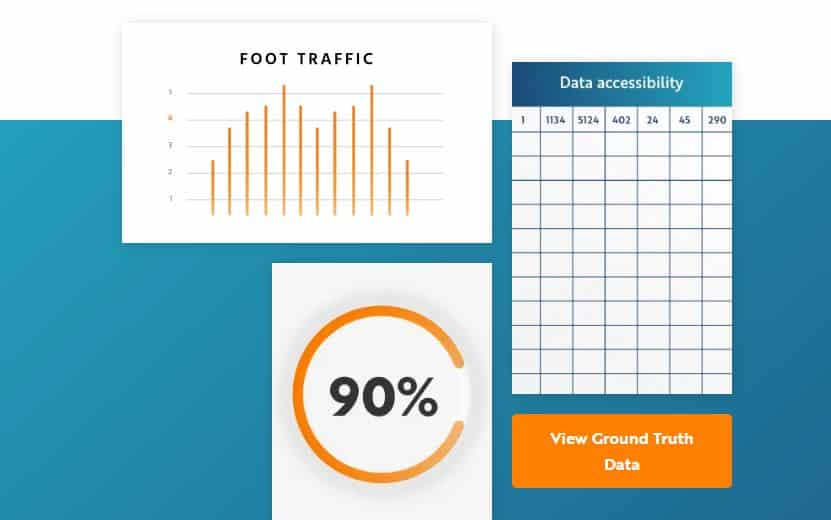

Unacast provides the industry’s most accurate location data, with our foot traffic data showing a historical correlation of .93 with ground truth data. Hundreds of retail brands trust Unacast due to our rigorous focus on methodology and high level of transparency with our clients. Unacast helps retailers around the world with things like site selection, competitive intelligence, and making data-informed decision.

In this case study, we share how a national retail brand used location data insights from Unacast to make informed decisions on optimizing its brick and mortar strategy.

The Challenge

A nation-wide retail brand faced the challenge of expanding into new markets after announcing plans for aggressive growth. Its strategy involved entering new markets, expanding distribution with additional facilities, and introducing new product offerings. In order to execute on this plan, the retailer needed to reevaluate the locations of its stores in accordance with depleting or growing populations, and find opportunistic gaps in the marketplace. To address this challenge, the brand used location data insights from Unacast to make informed decisions on how to optimize its store mix. The retailer evaluated the locations of its stores based on Unacast’s migration trends, foot traffic patterns, and demographic data. By augmenting its market analysis with Unacast data, our client was able to identify new areas of growth, benchmark competitors’ visitation and foot traffic, and find gaps in the marketplace.

Identifying areas of growth

To identify areas of growth, the retailer used Unacast’s migration pattern data at the census tract level to assess growth by month. This unveiled where there were gains or losses in both population and income down to a detailed level. By focusing on areas with growing populations and with its target, above-average income levels, the brand was able to identify likely locations for new stores. For example, a specific census tract in the west showed both population and income growth, with each new person coming in averaging about $14,000 more than the local median income. This information was useful for the retailer to consider when deciding on store locations and product assortments for the county.

Benchmarking competitors’ visitation and foot traffic

The retailer used Unacast’s footfall data as a proxy to measure their market share and regional dominance over the trailing 12 months. This helped the brand inform its decision-making around where to position new stores and gain some of its competitors’ market share. By studying peak visitation metrics and cross-visitation patterns around competitors’ stores, the retailer gained detailed competitive intel that helped in making decisions on size and location of new sites. Digging a little deeper, the retailer was able to augment its knowledge of the market-leading competitor’s store’s concepts and assortment, and created an optimally suited in-store experience for the new location’s local shoppers.

Finding gaps in the marketplace

The retailer looked at the distance traveled by visitors to a competitor’s store (known as catchment area) that was previously identified as having the highest rate of visitation among local competitors. While almost two-thirds of the visitors came from within 6 miles of the store, we also found that about one-third traveled greater than 6 miles. This presented an opportunity for our client to locate a store a little closer to the visitors coming from more than 6 miles away.

Solution features

Use-Case customer:

Benchmarking

Location: 245 5th Ave, 10016 , United States

Use-Case-Region: North America

Website: https://www.unacast.com/